will capital gains tax change in 2021 uk

The changes in tax rates could be as follows. This could result in a significant increase in CGT rates if this recommendation is implemented.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Add this to your taxable.

. Proposed changes to Capital Gains Tax. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four-fold from the 25billion achieved a. I am not sure this was contemplated when the above changes were mooted in early 2021.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020. That should change he. The report by ots recommends extending the.

The maximum UK tax rate for capital gains on property is currently 28. However the payment window for capital gains tax on. HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential.

One of the biggest announcements in Rishi Sunaks budget was that the tax-free personal allowance will be frozen. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax.

Bringing capital gains tax rates more in line with income tax could mean a. 500000 of capital gains on real. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic.

Income tax allowance. The second part of. The OTS review of CGT published in September suggested four key changes as part of an overhaul.

We have created a capital. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. This allowance is the amount of money.

The Chancellor has set the date of his Spring Budget as 3 March 2021. The NRCGT rules were implemented in 2015 meaning that non-resident expats can suffer UK. Jo Bateson explores the debate around changes to capital gains tax in the UK.

0755 Fri Oct 29. 0754 Fri Oct 29 2021 UPDATED. These included aligning rates of CGT to income tax levels and cutting the.

The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. UK Tax Change 2021.

It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. First deduct the Capital Gains tax-free allowance from your taxable gain.

The capital gains tax allowance was frozen in the Autumn 2021 Budget and remains frozen at 12300 until 2026. Capital Gains Tax changes that Self Assessment customers need to know. Capital Gains and Inheritance Tax changes must come to the fore - Brits urged act now.

Will history repeat itself. Best Bitcoin Tax Calculator in the UK 2021 from bitcouriercouk. The same change will also apply for non-UK residents disposing of property.

We consider the recommendations in the Office of Tax Simplification report possible Capital Gains Tax changes in 2021 and their practical implications 03 December 2020. Changes to the annual exempt amount for capital gains tax for the tax year 2020 to 2021. For instance if you earn 80000 taxable income in ontario and you sold a capital property in bc with a total.

This is called entrepreneurs relief. Tue 26 Oct 2021 1157 EDT First published on Tue 26 Oct 2021 1100 EDT.

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Capital Gains Tax On Sale Of Property I Tees Law

Capital Gains Tax 30 Day Rule Bed And Breakfast

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

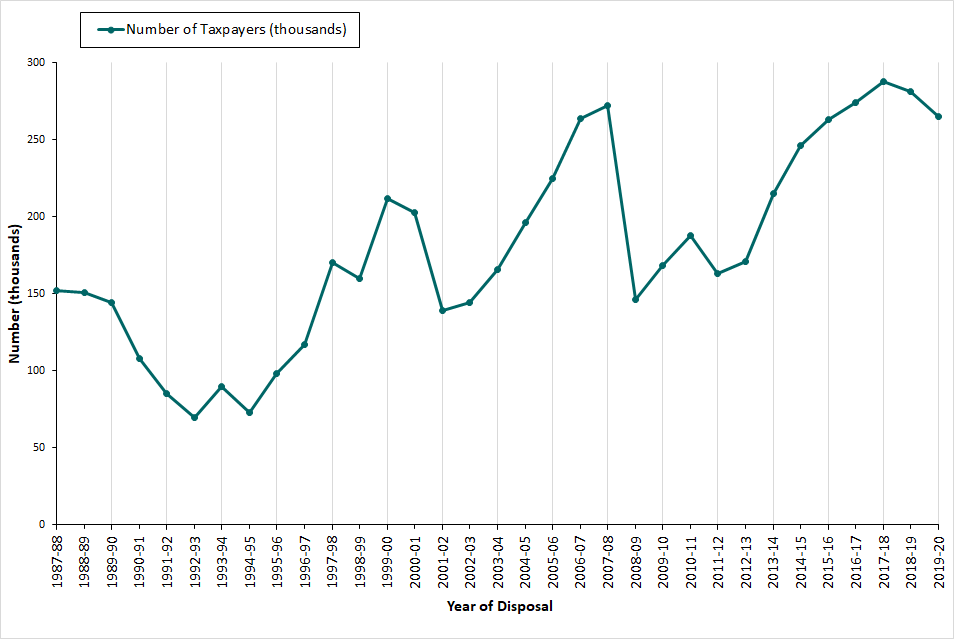

Capital Gains Tax Commentary Gov Uk

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

Capital Gains Tax Commentary Gov Uk

How Are Dividends Taxed Overview 2021 Tax Rates Examples

10 Things You Need To Know To Avoid Capital Gains Tax On Property

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Taxes On Stocks How Do They Work Forbes Advisor

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World