rank real estate asset classes by risk

Managing a troubled asset requires real estate professionals with multiple disciplines to ensure risk minimization and maximum value for the owner. Each real estate asset class has its pros and cons.

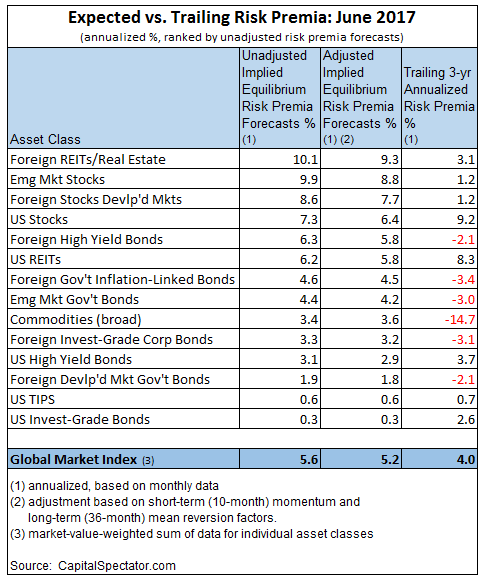

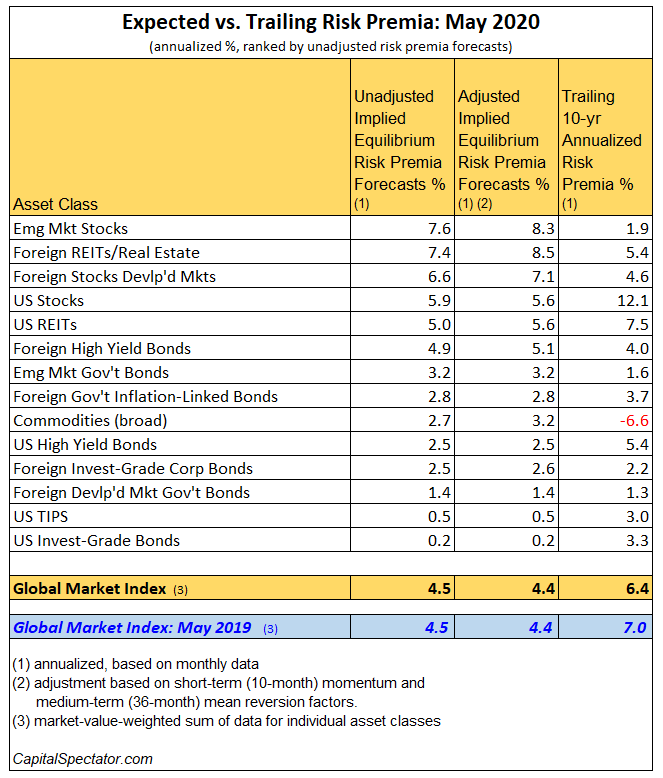

Risk Premia Forecasts Major Asset Classes 6 July 2017 Investing Com

An asset class is a group of similar investment vehicles.

. Real estate has the highest risk and the highest. However today commercial real estate CRE is usually. Rank real estate asset classes by risk Wednesday June 15 2022 Edit.

AVP VP MVRM Market Risk Analysis and Control Portfolio and Asset Class Coverage. Although Class D properties arent best for investors Class A B and C properties are all solid options depending on your. Comparing long-term returns between real estate and the stock market is hard because each asset class has a wide variety of potential risks and rewards.

Real estate is a well-known asset class that has been used to build wealth for centuries defend against inflation and is sometimes referred to as recession-resistant. Real estate in terms of asset classes was often categorized within the sphere of alternative assets. As an asset class real estate investments.

Chart The Historical Returns By Asset Class Over The Last Decade Know Your Real Estate Risk Reward. The first asset class is real estate. However the most common types of asset classes to invest in are.

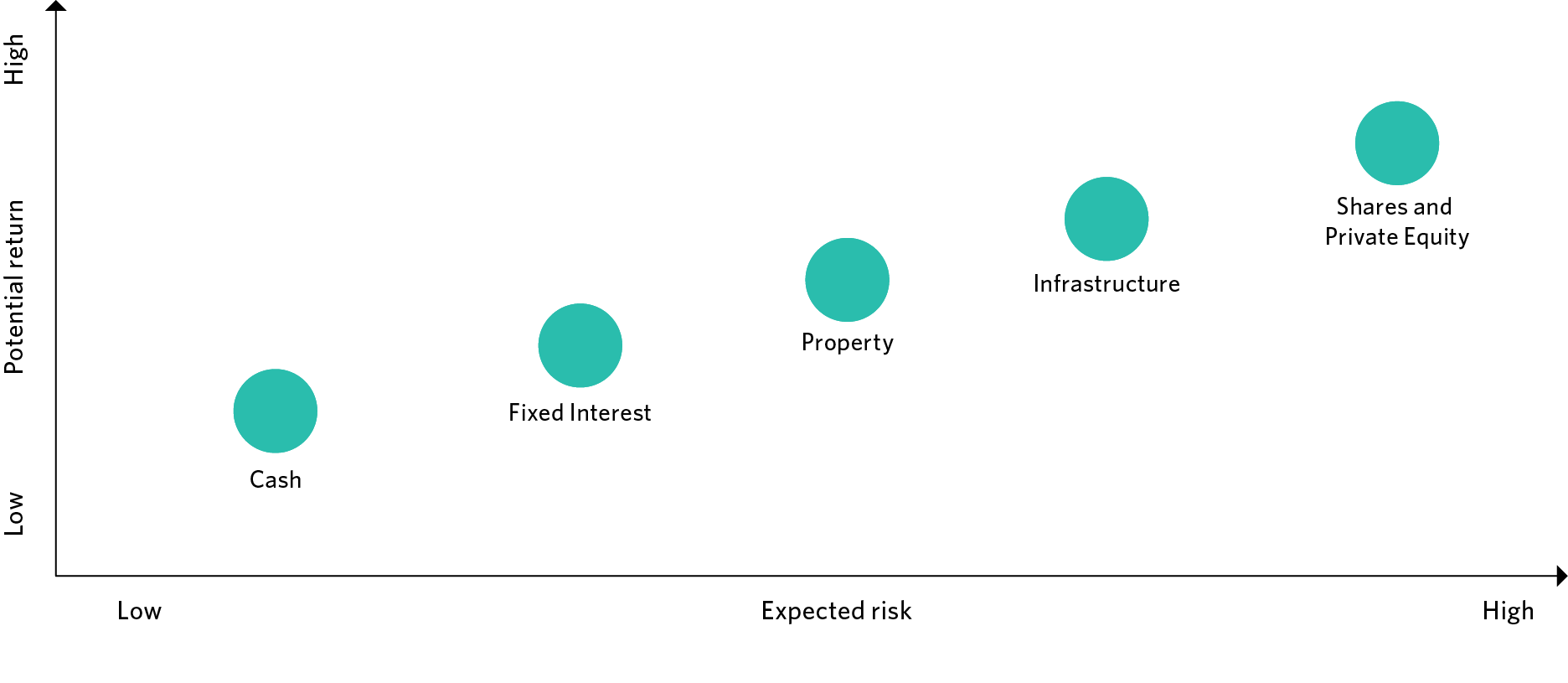

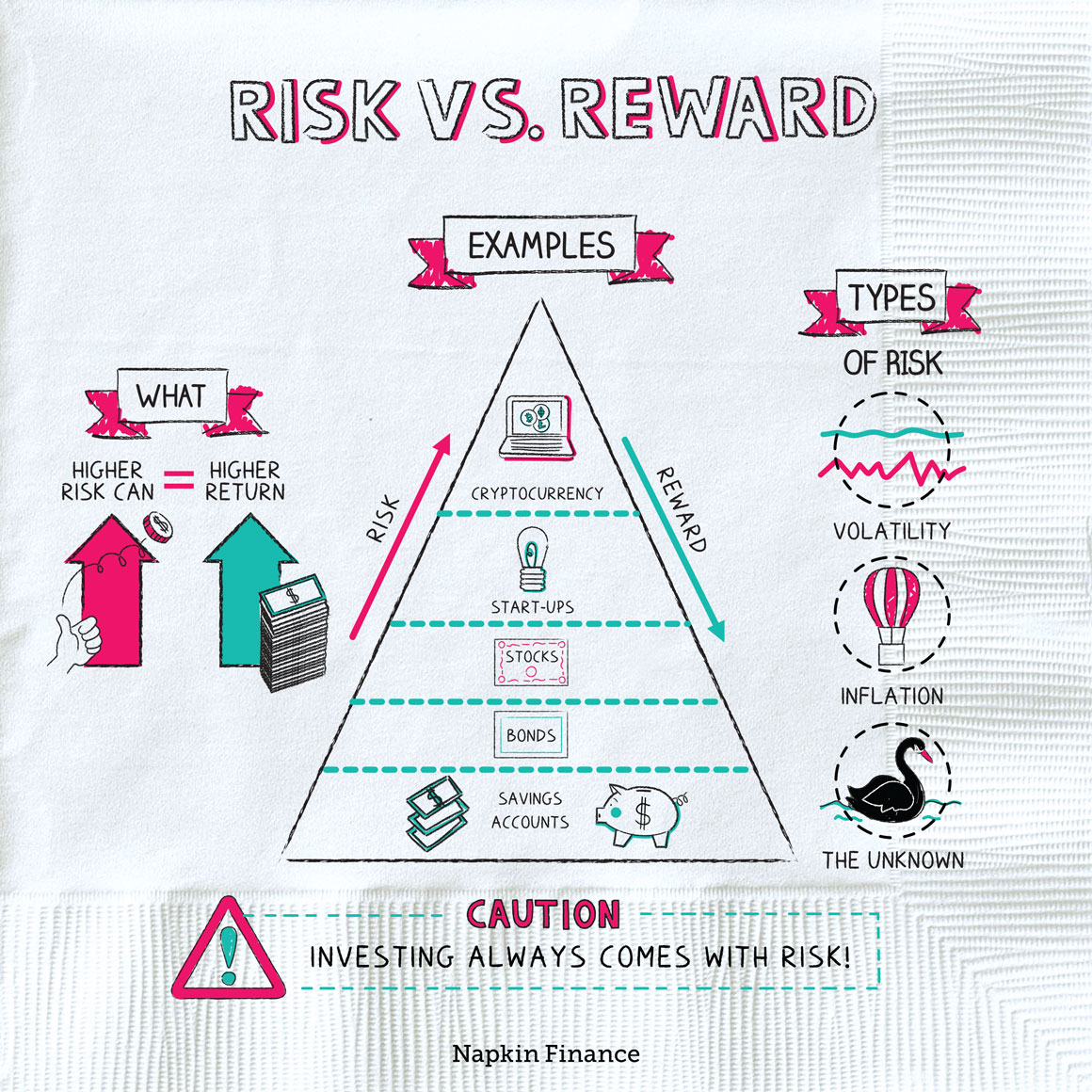

A real estate property class is how a real estate investment would be characterized - its a rating typically on an A - D scale that helps categorize neighborhoods and property. Here are the types of asset classes ranging from high risk with high return to low risk with low return. Asset class is a group of assets with similar characteristics particularly in terms of risk return liquidity and.

The Preferred-ranked Asset Classes are superior and all new funds should be put into Asset Classes ranked in this section. ASSET PRESERVATION INC 723 EASTSHORE TERRACE CHULA VISTA CA 91913. Deliver analysis and explain statistical.

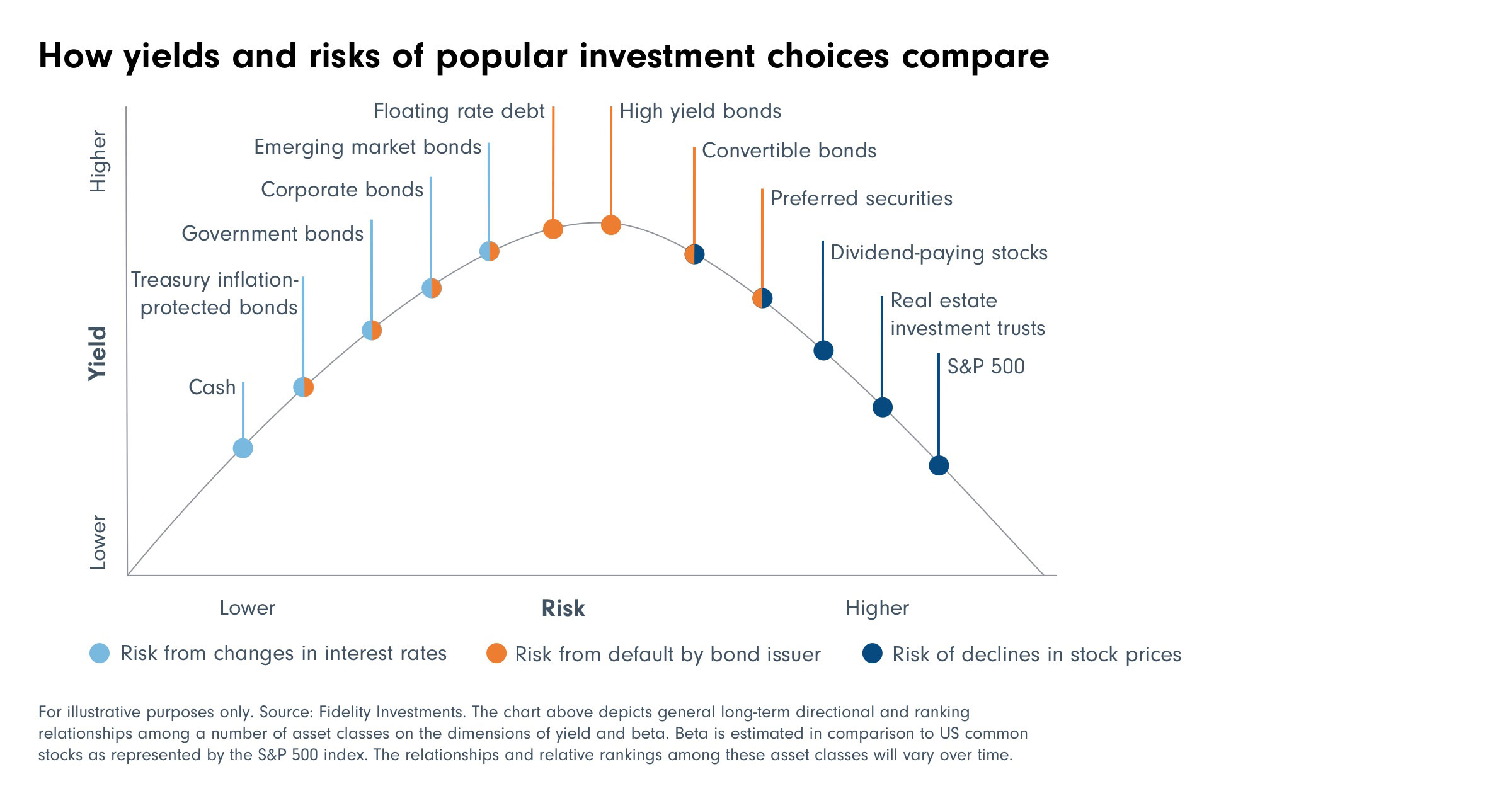

Different classes or types of investment assets such as fixed-income investments are grouped together based on. WORLD STAR REAL ESTATE SCHOOL 148-01 34TH AVE FLUSHING NY 11354 347-835-8271 WORLD WIDE. For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear.

1 Dec 2020. Buying high-risk real estate requires a larger. Our in-house team has overseen the.

Cash and cash equivalents Equity Fixed-income securities Real estate Commodities Derivatives Currencies. Ranking the real estate asset classes in terms of risk Dear all.

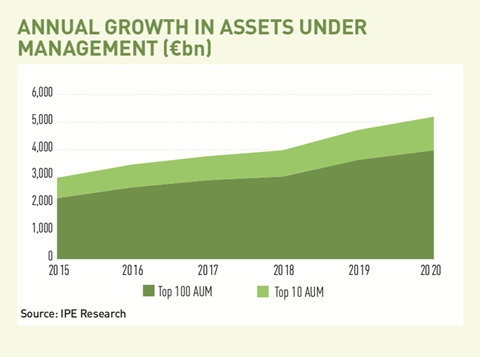

Top 150 Real Estate Investment Managers 2020 Magazine Real Assets

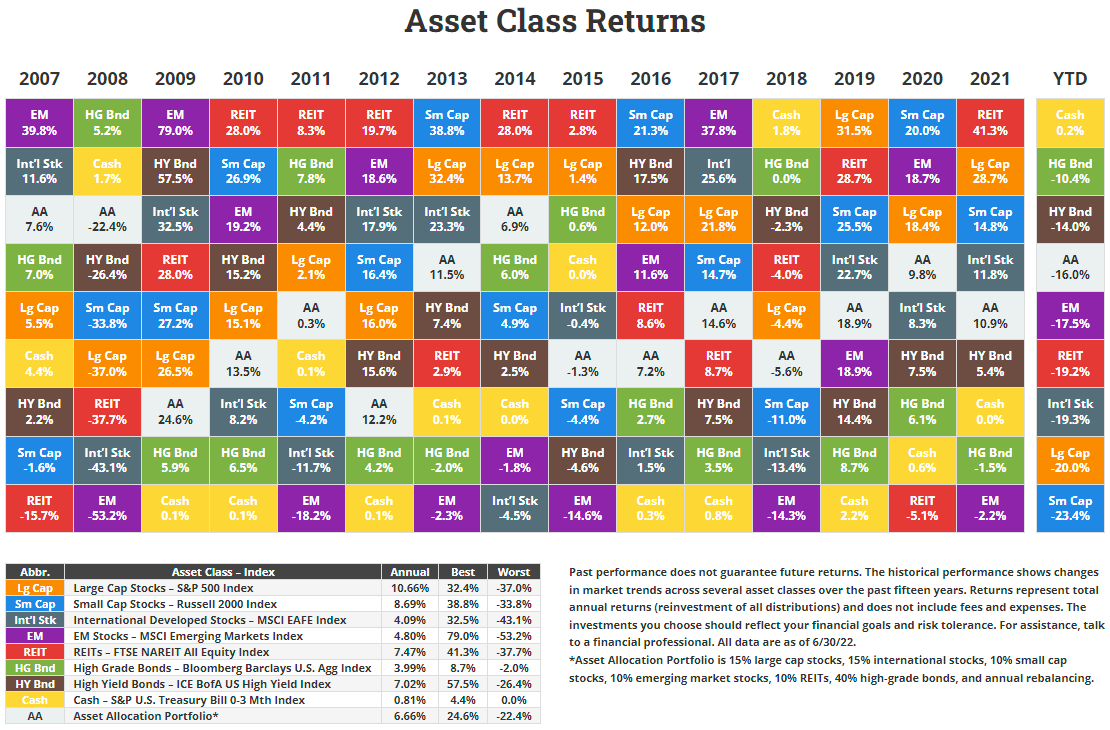

Annual Asset Class Returns Novel Investor

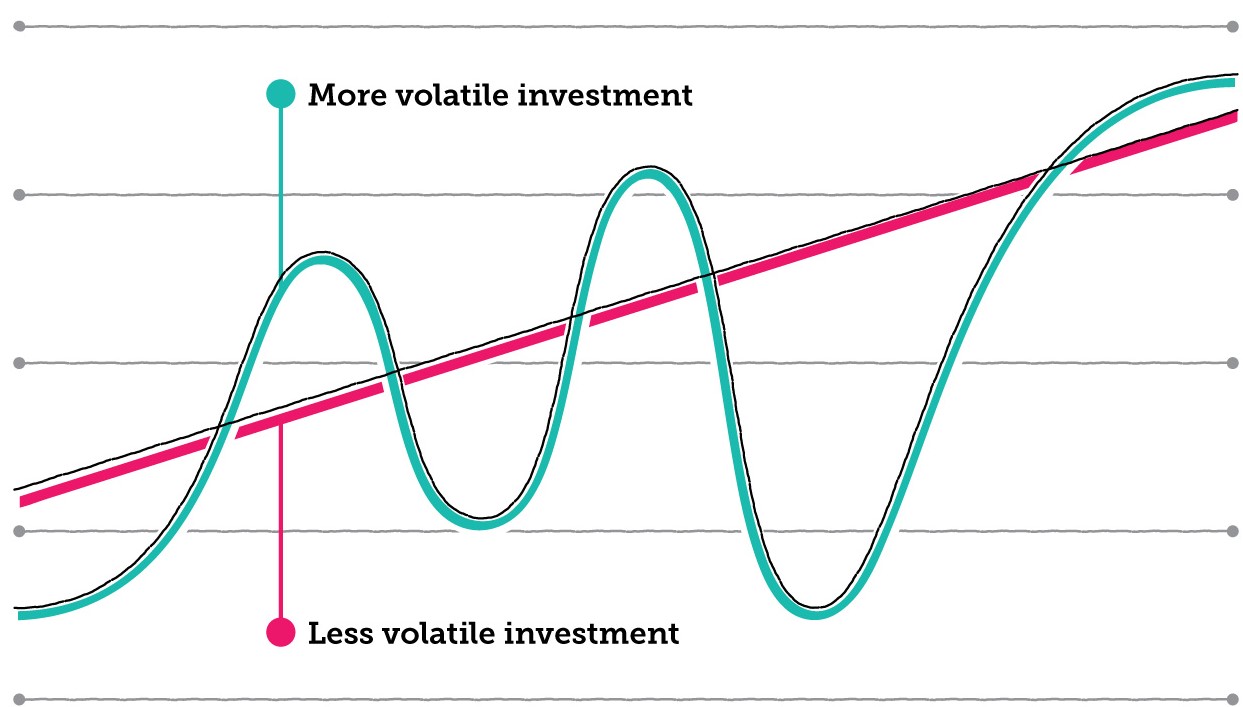

Napkin Finance Risk Vs Reward Trade Off Definition Risk And Return

Sub Asset Class Performance In A Rising Real Rate Environment

Real Estate Asset Classes Equitymultiple Learning Series

Real Estate Allocations And Integrating Risk Msci

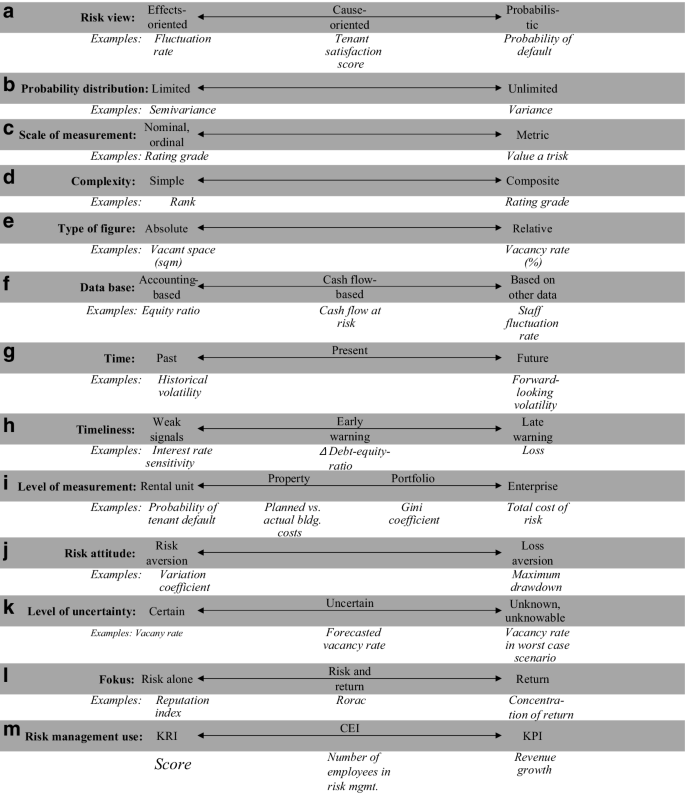

Risk Measures For Direct Real Estate Investments With Non Normal Or Unknown Return Distributions Springerlink

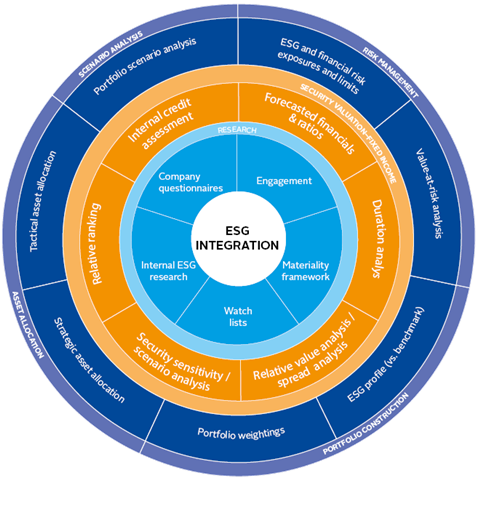

An Introduction To Responsible Investment Fixed Income Introductory Guide Pri

![]()

Real Estate Investing Get To Know The 3rd Largest Asset Class In The U S

Asset Classes Explained Understanding Investments Unisuper

21 Years Of Returns History S Lesson For Investors Financial Advisers Schroders

Making The Grade In Real Estate Understanding Class A B And C Crowdstreet

Risk Premia Forecasts For The Major Asset Classes See Upward Revision Investing Com

Real Estate Vs Stocks Other Assets Equitymultiple

5 Reasons Why Income Investing Can Potentially Help To Limit Uncertainty Fidelity Hong Kong

Napkin Finance Risk Vs Reward Trade Off Definition Risk And Return

Real Estate Investment Vs Other High Yield Asset Classes Gutzeit Tencer